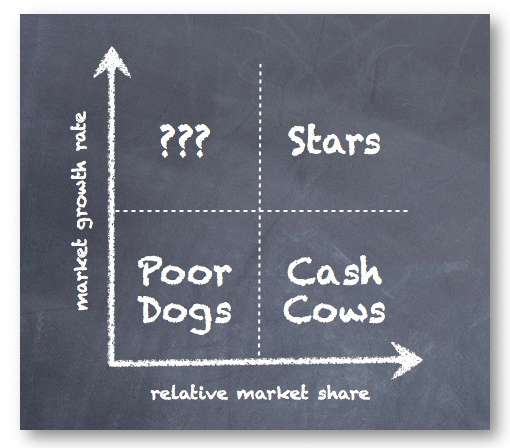

The BCG-Matrix, also known as the growth-share matrix, is a framework first developed by the Boston Consulting Group (BCG) in the 1960s to help companies think about the priority (and resources) that they should give to their different businesses. Also known as the BCG-matrix, it puts each of a firm’s businesses into one of four categories. The categories were all given memorable names — cash cows, stars, poor dogs and question marks — which helped to push them into the collective consciousness of managers all over the world.

The two dimensions of the BCG-Matrix are relative market share (or the ability to generate cash) and market growth rate (or the need for cash).

- Cash Cows – High market share but low growth rate (most profitable) [read more]

- Stars – High market share and High growth rate (high competition) [read more]

- Question marks – Low market share and high growth rate (uncertainty) [read more]

- Poor dogs – Low market share and low growth rate (less profitable or may even be negative profitability) [read more]

There are four strategies possible for any product or business unit, which are used after the BCG-Analysis:

- Build: By increasing investment, the product is given an impetus such that the product increases its market share. Example: Pushing a Question mark into a Star and finally a cash cow (Success sequence)

- Hold: The company cannot invest or it has other investment commitments due to which it holds the product in the same quadrant. Example: Holding a star there itself as higher investment to move a star into cash cow is currently not possible.

- Harvest: Best observed in the Cash cow scenario, wherein the company reduces the amount of investment and tries to take out maximum cash flow from the said product which increases the overall profitability.

- Divest: Best observed in case of Dog quadrant products which are generally divested to release the amount of money already stuck in the business.